BC Property Assessments – What You Need to Know When Selling a Home

What does the property assessment of a property tell you about the value of a home when you are buying or selling a home in Oak Bay, Victoria, Saanich & Sidney?

We are often asked by home buyers and sellers in Greater Victoria how the BC Assessment will affect the sale or purchase price of a residential property.

According to BC Assessment, your property assessment is based on the “Market Value” or “the most probable price which a property should bring in a competitive market under all conditions requisite to a fair sale, the buyer & seller, each acting prudently, knowledgably and assuming the price is not affected by undue stimulus”

But here are the top reasons why you shouldn’t rely on the property assessment of a house, condo or townhome when deciding what you should list your home for or what you should pay for a property that you are interested in buying:

- The property assessment is based on real estate data from July of the previous year. So, when you get your assessment, the information is already 6 months old. The Greater Victoria Real Estate market is constantly changing and valuations that are 6 months old are not representative of the current market value of a home.

- It is not based on a physical walk through of the home. BC Assessment will look at MLS Listings, aerial flyovers, municipal information (permits, plans, etc.) and only in the rarest of occasions, interviews with vendors, purchasers and Realtors. Let’s say you have done a bunch of renovations that didn’t require a permit e.g., flooring, etc. This will not be reflected in the home’s value.

- The property assessment does not take into consideration current market conditions like inventory levels and whether it is a buyer’s or a seller’s market.

- The BC property assessment is based on the average for the area. For example, you could build a gorgeous 5000 square foot mansion on a lot in downtown Victoria, but the best use is for the lot is multi-unit condo building. As such, your assessment would likely show significant value for the land, but give very little value for the mansion (or what is listed as “improvements” on your assessment) even if you spent $2000 a square foot building it). Another example would be the assessed value for a rural property that has added a suite, but the market has shown that there is little demand for rental suites in the area. As such, the suite you added may do very little to increase your assessment, while adding the same suite in Victoria’s core areas would affect the BC Assessment significantly more.

As a seller, it’s important to realize that most home buyers will look at the assessed price ( even when it doesn’t reflect the current market value for your home) and try to use it as negotiation tactic. That’s when we, as your listing agents, step in – we do our part to demonstrate the true market value of your home and develop a marketing strategy that highlights the features in such a way that helps get you the maximum amount when you sell your home.

If we are working with you as a buyer, we will do the research and run the numbers based on recent sales in the neighbourhood compared to the property you are considering offering on to make sure you don’t overpay.

While BC Assessment doesn’t provide exact algorithms for how they come up with a property’s assessed value, here are some common questions we get from home buyers and home sellers in Greater Victoria about assessed values of developable land, houses, condos, duplexes and townhomes.

Q. What are some of the top factors that affect your BC Assessment?

A. The top factors that affect you BC Property Assessment are:

- Location of building (is it appropriate for the area?

- Quality and type of home

- Age and the effective age vs. real age of the home (e.g., if it is a 1920’s house that was completely renovated in 2017, it has an effective age of 2017)

- Size of house/finished square footage and cost to build

- Components: e.g., bathrooms, bedrooms, basements, suites, etc.

- Improvements relative to the area (e.g., adding a suite to a single-family home in Fairfield, will add more value than adding a suite in a rural community.)

Q. If I filed permits that reflect $200k worth of improvements, will my BC Assessment show that increase in my next BC Property Assessment?

A. It depends on the quality of home and the quality of finishes. If the renovation fits the home, and the location/neighbourhood of the home that it is likely that it would reflect. However, if the home is renovated to a level the exceeds the average value for the neighbourhood it may not be reflected.

Q. I’m thinking of doing some renovations including adding a bathroom. Is there a standardized list of how much my BC Assessment will increase if for example I add a bathroom?

A. BC Assessment does not have a standardized list of how much assessed value increase to expect for various home improvements. It will vary greatly depending on the neighbourhood, type of house and market averages. For example, if you add a bathroom to a house that should be torn down, it won’t increase your BC Assessment. If you are more interested in finding out what the average returns are for various renovations when you go to sell, check out our article on which home renovations bring the highest return on your investment.

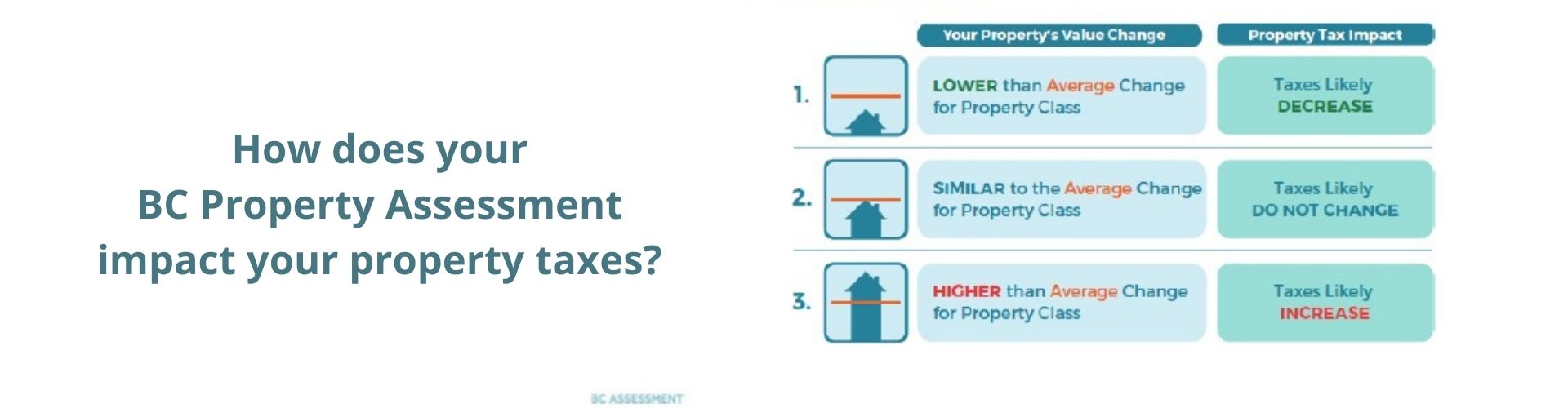

Q. If my BC property assessment goes up will my annual property taxes go up by the same amount?

A. Many people think the answer to this question is yes, but in fact your taxes don’t always go up when your assessment increases. It is based on the averages of similar properties and your municipal budget. However, because municipal budgets tend to increase every year, unfortunately, property taxes seem to as well.

Q. I have an easement running across my property in Oak Bay how will it affect my property assessment?

A. There are many property easements or covenants that have a little to no effect on a property’s assessed value, and there are others that do. For example, if you had a wide easement running through the middle of your property and it affects the ability for you to build on the property – your assessment would be lower than a neighbouring property without this type of easement. BC Assessment will typically review easements and covenants to determine if they should impact the value of the property.

Q. I have a house in Fairfield and I think my BC property assessment is too high (or too low) what can I do?

A. Anyone can appeal their property assessment, here are few things to consider if you decide to go down the route:

- Property Assessments are delivered in early January

- You have until January 31 to appeal your assessment

- The appeal panel will typically look at 3 to 5 comparable properties, information from the owner and recent sales data.

- When you are appealing, do not focus on one component that may affect the value of your home. For example, a common appeal argument is that a neighbour’s home went up by a different percentage. E.g., Your home went up 10% and theirs only 6%. This is not a “good argument”, according to BC Assessment representatives.

- Corrections to your assessment are not retroactive. If you find an error in your assessment that either the Property Assessment Review Panel or the Property Assessment Appeal Board agree to, it would be corrected from the date forward and not be retroactive. So, if you were overpaying taxes because of an error, you will not get a refund.

- You can learn more about BC Assessment appeal process here

Q. I was in a multiple offer situation for a home in Victoria, but really fell in love with the house and purchased the property for significantly more than the assessed a value. Will the assessed value from BC Assessment now match my purchase price?

A. It’s unlikely that the assessed value will be the same as your purchase. If there is a significant difference between your BC assessment value and the purchase price, BC Assessment will often do further investigation to see if the assessed value when you purchased was too low. It’s likely that assessed value would go up some, but your BC Assessment is not supposed to be tied to the purchase price, it is based similar properties and averages for the area.

Q. My neighbour heard that I’m thinking of selling my house in Oak Bay and he is interested in purchasing it. Is the assessed value from the government a good way to decide on a sale price?

A. If you base your home’s price on the BC Assessed value, it’s likely you will be leaving money on the table. When working with home sellers in Oak Bay and all-over Greater Victoria, we do a comprehensive market analysis (CMA) before coming up with a recommended listing price for a home. Our CMA looks at over 30 data points before coming up with a valuation on your property. It also includes a customized market strategy to maximize the exposure and sale’s price of your home.

A number of our clients who we have sold properties for, have shared similar stories of a neighbour being expressing interest in purchasing their house. However, more often than not, when they learn of the market value of the home, they are no longer interested in purchasing it. Ultimately, we end up listing the home and netting our clients significantly more money than they would have made in a private sale.

If you have additional questions on the value of homes in Oak Bay, Victoria, Saanich, Sidney or other areas of Greater Victoria contact us – we’re here to help. You can also find additional BC Assessment resources here.

If you have questions about buying and selling real estate, whether it’s a condo, waterfront home, or vacation property home in and around Victoria, BC, just Contact us – we are here to help.

Ready to Open a New Door?

TOGETHER, Hal Decter, LL.B. and Audra Poole bring a unique level of knowledge, experience and service that is hard to find.

For eleven years, Hal Decter was a practicing real estate lawyer and partner with one of Canada’s top law firms. His client experience ranges from some of the country’s largest corporations to individuals and couples starting their first businesses or buying their first homes.

Audra Poole brings her research acumen and luxury marketing and sales talents to the team. She is a highly respected marketing and public relations executive with more than twenty years of local, regional and international experience.

Whether you are looking to buy or sell a home in Victoria, Oak Bay, Sidney or Saanich – we’ll be on your side and make the process as stress free and seamless as possible.