Victoria Real Estate Market January 2024 Update

While most people agree that the frothiest of the real estate market has tempered, Victoria tends to be a bit of an anomaly. While January is typically a slower month, we have already seen multiple offer situations and we are anticipating a brisk spring real estate market.

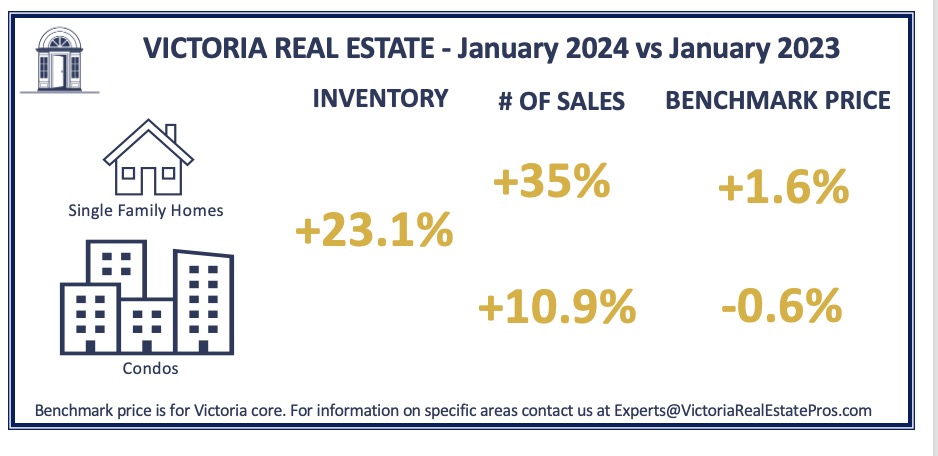

A total of 341 properties sold in the Victoria Real Estate Board region this January, 22.7 per cent more than the 278 properties sold in January 2023. Sales of condominiums were up 10.9 per cent from January 2023 with 112 units sold. Sales of single-family homes increased 35 per cent from January 2023 with 162 sold.

There were 2,140 active listings for sale on the Victoria Real Estate Board Multiple Listing Service® at the end of January 2024, a 23.1 per cent increase from the 1,739 active listings for sale at the end of January 2023.

The Multiple Listing Service® Home Price Index benchmark value for a single-family home in the Victoria Core increased by 1.6 per cent compared to last year. However, the benchmark price for condominiums decreased slightly by 0.6 per cent.

So, what’s in store for home sales in 2024? BCREA chief economist Brendon Ogmundson expects 2024 to be a “delicate balance between rising sales and normalizing inventories, which should lead to a relatively quiet year for prices.”

The impact on prices will depend on how inventory changes over the year, the BCREA says.

“While risks to the economy remain, our view is that new listings normalize following a lull in activity last year,” it said. “That normalization of new listing activity should result in a more balanced market this year with relatively stable pricing.”

It’s important to remember that stable pricing does not mean no increases. In fact, in the same press release, BCREA is forecasting a 1.3% increase in MLS prices in 2024 and 2.5% in 2025.

TD Bank chief economist Beata Caranci said declining bond yields have fed through to fixed mortgage rates on offer in the market, pulling buyers off the sidelines as they qualify for cheaper mortgages.

“We are already seeing homebuyers jump back into the market,” she said.

If the Bank of Canada delivers on expectations for interest rate cuts – TD Bank expects a decline of 100-150 basis points this year – that will serve to ignite housing activity, particularly in the second half of the year, Caranci said.

Lower mortgage rates typically mean more homes will change hands, which sets up a conundrum for many homebuyers. The decision that consumers need to make is, do I wait for cheaper money, or do I get in ahead of rising home prices?

As always, if you have questions about buying or selling in today’s market, just reach out. We would be happy to sit down with you and discuss the best strategy and timing based on your situation.

For more statistics on the Victoria real estate market – click on the links to the right for the latest reports and data from the Victoria Real Estate Board, the British Columbia Real Estate Association, the Canadian Mortgage and Housing Corporation and the Canadian Real Estate Association.